Articles

These types of extra spins can be used regarding certain online game inside concern, and as opposed to regular no deposit incentives, they can’t be paid around the multiple games. Since the ten no deposit bonus requires that you allege the new spins first, it’s maybe not a free give because the a number of the other bonuses on this number. Although not, the total worth is indeed high, that individuals of course strongly recommend which incentive, as the the totally free revolves wins is cashable inside the real cash. Having a game title alternatives almost as huge as BetMGM, Borgata is one of the greatest casinos on the internet in the us. The fresh 20 no deposit bonus merely offers a 1x wagering, meaning that the questioned really worth is approximately 19.50 if you play slots with high come back to player. Becoming eligible for added bonus depreciation, eligible assets should be MACRS property having a helpful lifetime of 2 decades or quicker, particular depreciable software, or being qualified leasehold improve possessions.

- Your usage of this website comprises greeting of one’s Regards to Fool around with, Supplemental Terms, Privacy, Cookie Plan, and Individual Fitness Investigation Notice.

- The fresh court processing shows it also comes with possible additional compensation to help you be the cause of the amount of time value of currency missing while the FTX’s bankruptcy proceeding.

- However, such provisions will be only be leveraged once they make enough time-name monetary experience for your team.

- Full expensing is a robust, pro-gains provision because relieves a great prejudice in the taxation password one to discourages money in the united states.

That’s the plan, unless of course Congress extends the main benefit decline rate. Possessions bought before September 27, 2017 are susceptible to prior tax laws for bonus depreciation. Which have added bonus decline, you could potentially subtract the cost the site of both their staplers and you may heavier equipments around purchased and place to function. The brand new processes to subtract one another expenses will vary, nevertheless bottom-line effect is similar. Such, say a coffee shop ordered a keen espresso machine for ten,one hundred thousand. As opposed to reporting the whole 10,one hundred thousand debts to your their income statement and team tax come back in the season one, a shop create report step one,100 inside the depreciation per year to possess 10 years, the computer’s useful existence.

How does Bonus Depreciation Work? | the site

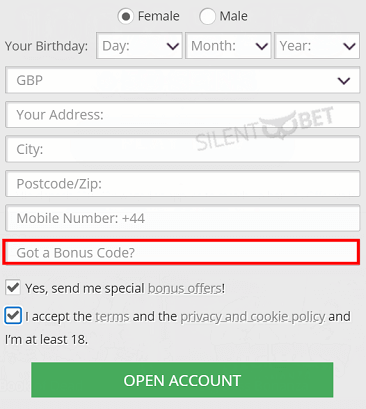

By far the most widely accessible models is acceptance incentives and you may reload bonuses.A good 100percent put added bonus might be claimed by both the newest and you can existing people if they proceed with the best tips and you can respect the brand new small print. Casumo also offers two varying invited incentives according to whether you’re a United kingdom otherwise Line user. British profiles discovered a great 100percent added bonus all the way to twenty-five, while Line customers can also be assemble a big 100percent added bonus capped from the €3 hundred. Need to discover more about exactly how incentive depreciation or any other repaired investment management tips get well can cost you and alter your team’s income?

Income tax And Accounting Regions

Added bonus depreciation might possibly be 0percent for possessions placed in services on the January 1, 2027, and soon after. Changed Accelerated Prices Recovery System possessions having a data recovery period of two decades otherwise smaller. For example for example possessions as the computers gadgets and you may workplace furniture. Added bonus depreciation try a tax extra that cannot become shown within the your financial comments. No matter what you depreciate the assets to have income tax aim, pursue essentially acknowledged accounting prices when creating your financial statements.

Q3: Does Simply The newest Assets Qualify for The additional First 12 months Decline Deduction While the Revised Because of the Tcja?

Extremely, it internet casino will not only render a great 100percent incentive to have the initial put but for the initial four! Your first four places will be matched to help you a big €400, adding up to help you a deposit bonus of €1600! There is a minimum deposit out of €ten and a little a leading betting requirement of 50x. Casumo’s thrill-dependent strategy rewards its participants because they advances regarding the local casino’s betting world.

By the perhaps not claimingCode Sec. 179expensing, or electing from bonus depreciation, a taxpayer increases newest-seasons nonexempt earnings, but can offset the raise because of the utilization of the expiring taxation work with, and you can receive the deferred decline deductions in the future ages. Sure, profitable a real income is definitely possible if you use no deposit bonuses playing online slots games. You could enjoy from the a website one of online sweepstakes gambling establishment real cash Usa in most states without the need for one buy and you may receive prizes the real deal money. Incentive depreciation allows an excellent taxpayer to reduce the short-identity taxable earnings by cost of depreciable assets.

Do you know the Benefits associated with Added bonus Decline?

Management functions, accommodation and eating characteristics, and you can elite functions could substantively make use of to make completely added bonus decline long lasting. Very first, 100 % added bonus depreciation causes it to be likely to be you to definitely a corporation is actually subject to the worldwide lowest taxation. Yet not, accelerated depreciation will not fundamentally cause minimal taxation liability. For the reason that deferred taxation liabilities try valued at the 15 % minimum taxation speed and you will measured while the current taxation accountability.

Lower than this technique, their depreciation log entry, made up of depreciation costs and collected decline, will look a comparable yearly. The new Area 179 deduction limitation is decided during the 1,040,000 to have 2020, where extra depreciation does not have any including limitation. Their Point 179 deduction along with usually do not perform a web losses for your own portion of team earnings. Including, if you have 5,100 operating earnings and want to expenses all the ten,100 of one’s shiny the brand new resource, it’s a zero-go. The newest taxation rules lets bonus depreciation to possess real property that have an IRS-dictated of use lifetime of 2 decades or reduced. Devices, gadgets, computers, equipment, and you will chairs belong to this category.